Does insurance cover TB skin test? Ini pertanyaan penting buat yang mau ngecek kesehatan. Banyak banget faktor yang bisa ngaruh ke coverage asuransi, mulai dari jenis polis sampai riwayat kesehatan. Artikel ini bakal ngebahas detail tentang hal itu, jadi bisa bantu lo ngerti lebih jelas dan ngambil keputusan yang tepat.

Nggak cuma ngebahas coverage secara umum, kita juga bakal bahas langkah-langkah klaim, dokumen yang dibutuhkan, dan perbedaan coverage di berbagai perusahaan asuransi. Pokoknya, siap-siap jadi lebih paham soal TB skin test dan asuransi lo!

Understanding Insurance Coverage

Health insurance plays a crucial role in affording access to necessary medical procedures. It helps individuals and families manage the financial burden of healthcare services, including preventative care. Understanding the specifics of your insurance plan is vital to knowing what medical tests and services are covered, and which ones may require out-of-pocket expenses.Insurance coverage for medical procedures is typically determined by the specific plan you have.

Different plans have varying degrees of coverage for different types of care, including preventative measures. The amount you’ll pay depends on your plan’s type and the specific procedure. A thorough understanding of your policy is essential to making informed decisions about your health.

Types of Health Insurance Plans and Coverage

Various health insurance plan types exist, each with its own coverage stipulations. Health Maintenance Organizations (HMOs) often emphasize preventative care to reduce the overall cost of healthcare. Preferred Provider Organizations (PPOs) provide more flexibility in choosing providers but may have higher out-of-pocket costs. Exclusive Provider Organizations (EPOs) offer a middle ground between HMOs and PPOs, while Point of Service (POS) plans combine elements of both HMO and PPO plans.

Each plan type has its own criteria for coverage, which are crucial to understanding your benefits.

Coverage for Preventative Care

Many insurance plans, particularly those emphasizing preventative care, include coverage for routine health screenings and vaccinations. This is often seen as an investment in long-term health, and the coverage encourages proactive health management. However, specific coverage can vary widely, with some plans offering comprehensive preventative care benefits while others have more limited options. The degree of coverage also depends on the specific preventative care service.

Examples of Covered Medical Tests

Examples of medical tests commonly covered by insurance include routine blood work, cholesterol screenings, mammograms (for women), and Pap smears (for women). The specific tests covered and the extent of coverage are dependent on the specific plan details. These preventative measures are crucial for early detection and management of various health issues.

Common Exclusions in Health Insurance Policies

Some preventative care services, though crucial for well-being, may not be covered by all insurance plans. For instance, some plans may not fully cover certain types of vaccinations or advanced screenings. Moreover, coverage may be limited for tests or procedures deemed experimental or investigational. It is essential to review your policy carefully to understand the exclusions and limitations.

Comparison of TB Skin Test Coverage Across Insurance Plans

| Insurance Plan Type | TB Skin Test Coverage | Exclusions |

|---|---|---|

| HMO | Generally covered, but may have restrictions on providers. | Potential limitations on testing frequency or specific providers. |

| PPO | Generally covered, with more provider choice. | Higher potential out-of-pocket costs compared to HMOs. |

| EPO | Usually covered, with more flexibility than HMOs. | May have limitations on provider network access. |

| POS | Coverage varies based on the chosen plan features. | Exclusions may apply depending on the specific chosen provider and services. |

This table provides a general overview. Always refer to your specific policy documents for precise details regarding coverage and exclusions. Coverage details can change over time. This comprehensive understanding of your plan ensures proactive health management.

TB Skin Test Procedure and Requirements

The tuberculin skin test (TST), commonly known as a TB skin test, is a crucial diagnostic tool for identifying latent tuberculosis infection (LTBI). Understanding the procedure and associated requirements is vital for both patients and healthcare providers to ensure accurate results and appropriate management. This process involves a specific injection technique and observation period, with potential insurance implications depending on various factors.

TB Skin Test Procedure

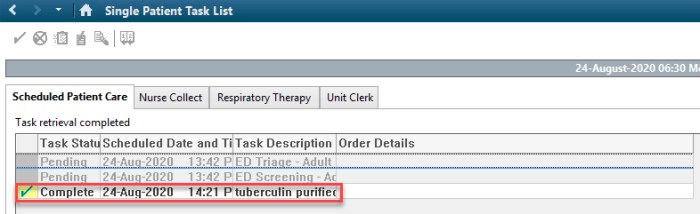

The TST procedure involves injecting a small amount of purified protein derivative (PPD) beneath the skin, typically on the forearm. A healthcare professional carefully inserts a needle to inject the PPD, creating a small wheal or bump at the injection site. The injection site is then carefully marked with a pen. The patient is then instructed to return to the same healthcare provider for a follow-up visit to evaluate the reaction.

Observation Period

Following the injection, the patient must return to the healthcare provider on a specified date, typically within 48 to 72 hours, for a visual examination of the reaction. The healthcare professional will carefully measure the induration (hardening) of the skin at the injection site. A positive reaction, indicating a possible infection, is typically measured in millimeters of induration, with specific cut-offs determined by factors like age and risk factors for TB.

The observation period is crucial for accurate diagnosis.

Requirements for Scheduling a TB Skin Test

Scheduling a TB skin test often requires a physician referral. This referral may be necessary for insurance coverage. Pre-authorization may also be required by some insurance companies. The specific requirements vary widely by insurance plan, so patients should contact their insurance provider to understand their specific needs. Pre-authorization requirements can delay the process of receiving the test.

Factors Affecting Insurance Coverage

Pre-existing conditions, such as a history of TB or other immune-compromising conditions, may influence the insurance coverage for a TB skin test. Additionally, the patient’s overall health status and risk factors for TB exposure can also affect coverage decisions. Specific policies and conditions must be carefully reviewed.

Typical Steps in Getting a TB Skin Test

| Step | Description | Insurance Implications |

|---|---|---|

| 1. Consultation with Physician | Patient consults with their physician, who may order the test based on risk factors and exposure. | Physician referral often required for insurance coverage. |

| 2. Pre-authorization (if needed) | Some insurance plans require pre-authorization for the test. | Failure to obtain pre-authorization may result in denial of payment. |

| 3. Scheduling the Test | Patient schedules an appointment with a healthcare provider. | Confirm appointment schedule with insurance provider to ensure coverage. |

| 4. Injection of PPD | A healthcare professional injects PPD beneath the skin. | Confirm with insurance company if the healthcare provider is in their network. |

| 5. Observation Period | Patient returns for follow-up to evaluate the skin reaction. | Ensure proper documentation of the follow-up visit for insurance claims. |

| 6. Interpretation of Results | The healthcare provider measures the induration and interprets the results. | Ensure accurate documentation of results for insurance claims. |

Insurance Claim Process and Documentation

Submitting a claim for a TB skin test to your insurance company requires careful attention to detail and proper documentation. This process can vary depending on your specific insurance plan and provider, but generally involves gathering required medical records, completing claim forms, and potentially dealing with potential delays or rejections. Understanding the necessary steps and potential challenges can streamline the process and increase the likelihood of a successful claim.The claim process for a TB skin test often involves submitting documentation that verifies the test’s performance, the patient’s condition, and the physician’s diagnosis.

Thorough record-keeping and accurate reporting are crucial for ensuring a smooth claim resolution. This section details the essential steps and required documentation to navigate this process effectively.

Submitting the Claim

The first step in submitting a claim is to contact your insurance provider to understand their specific claim procedures and requirements. This includes confirming the coverage details for TB skin tests, understanding any pre-authorization or referral requirements, and obtaining any necessary claim forms. These forms often include details about the patient, the physician, the date of the test, and the test results.

Necessary Documentation

Accurate and complete documentation is vital for a successful claim. The required documentation typically includes:

- Physician’s Order/Prescription:

- Physician’s Notes:

- Test Results:

- Patient Information:

- Claim Form:

This document Artikels the medical necessity of the TB skin test and the physician’s rationale for ordering it.

Comprehensive notes from the physician regarding the patient’s medical history, the procedure performed, and any relevant observations are essential. This includes the physician’s assessment of the test results.

The official report from the laboratory performing the TB skin test, including the date of the test, the patient’s identification, and the measured reaction. This should clearly state the size of the induration or the result of the interferon-gamma release assay (IGRA).

Accurate patient details, including name, date of birth, address, and insurance information, are necessary for processing the claim.

The specific claim form required by your insurance provider. It usually includes spaces for patient details, physician details, test details, and any relevant medical codes.

Common Issues and Resolution

Potential issues during the claim process may include missing or incomplete documentation, incorrect coding, or a denial of coverage.

- Missing Documentation:

- Incorrect Coding:

- Coverage Denial:

If the claim is denied due to missing documentation, contact your physician to obtain the necessary missing information promptly. Provide a detailed explanation of the missing documentation and your efforts to acquire it to the insurance provider.

Beyond the mundane query of whether insurance covers TB skin tests, lies a deeper truth. Our physical well-being is intertwined with the subtle energies of the universe. Exploring the vibrant tapestry of existence, we discover that even seemingly mundane matters like party food, such as party food that starts with b , are opportunities for connection and joy.

Ultimately, understanding the nuances of health, like insurance coverage, requires a spiritual lens to truly grasp the interconnectedness of all things. This awareness deepens our appreciation for the subtle currents that govern our existence, leading us to a deeper understanding of the coverage we seek.

Verify the medical codes used on the claim form align with the services rendered and are compliant with your insurance provider’s guidelines. If incorrect coding is the reason for the denial, update the claim with the appropriate codes and resubmit it.

Review the denial letter carefully to understand the reasons for rejection. If the denial is due to a pre-authorization requirement, follow the steps Artikeld by your insurance provider to secure pre-authorization. If the denial is related to the medical necessity of the test, appeal the decision based on your physician’s justification for the test.

Essential Documents for a Successful Claim

| Document | Description | Importance |

|---|---|---|

| Physician’s Order/Prescription | Physician’s order for the TB skin test. | Demonstrates medical necessity. |

| Physician’s Notes | Detailed notes from the physician about the test procedure and results. | Provides context and justification for the test. |

| Test Results | Official report from the laboratory with test results. | Crucial evidence of the test outcome. |

| Patient Information | Patient’s details (name, address, insurance). | Ensures accurate claim processing. |

| Claim Form | Pre-printed form from the insurance company. | Facilitates standardized claim submission. |

Variations in Coverage Across Providers

Insurance coverage for TB skin tests varies significantly across different insurance providers. Understanding these variations is crucial for individuals needing this diagnostic test, as it can significantly impact the out-of-pocket costs. This section delves into the complexities of coverage policies, highlighting the importance of reviewing your specific policy details.Different insurance plans have varying approaches to covering TB skin tests.

Some plans may cover the entire cost, while others may only cover a portion, or not cover the test at all. The specifics of the coverage often depend on the plan’s type, the individual’s health status, and the reason for the test.

Coverage Policies of Major Insurance Companies

Major insurance companies may have different approaches to covering TB skin tests. Factors influencing coverage decisions include pre-authorization requirements, specific medical necessity criteria, and the provider’s network. A thorough understanding of these nuances is essential to determine the potential financial implications of the test.

Reviewing Your Specific Policy Details

Thorough review of your individual policy is critical to accurately determine your TB skin test coverage. Insurance policies often contain detailed information about covered procedures, exclusions, and applicable co-pays or deductibles. This review should be conducted before scheduling the test to avoid potential financial surprises.

Comparison of Coverage Policies

It’s crucial to understand the variations in coverage policies across different insurance companies. Comparing policies can help individuals anticipate potential costs and plan accordingly. A proactive approach to understanding your specific coverage is key to navigating the financial aspects of healthcare procedures.

| Insurance Provider | Coverage Policy | Details |

|---|---|---|

| UnitedHealthcare | Generally covers TB skin tests if medically necessary. | Requires pre-authorization and may involve co-pays or deductibles. |

| Blue Cross Blue Shield | Coverage varies by plan. | Some plans cover TB skin tests, while others may not. Pre-authorization and cost-sharing may be required. |

| Aetna | Generally covers TB skin tests if medically necessary. | Pre-authorization may be required, and co-pays or deductibles may apply, depending on the plan. |

| Cigna | Coverage varies by plan. | Some plans cover TB skin tests under certain conditions, while others may not. Cost-sharing and pre-authorization requirements might be present. |

| Anthem | Coverage varies by plan. | Review your specific plan details to understand the coverage policy for TB skin tests. |

Specific Scenarios and Examples

Insurance coverage for TB skin tests can vary significantly based on individual circumstances. Factors like pre-existing conditions, employment requirements, and the specific insurance policy all play a role in determining whether and how much a plan will cover. Understanding these nuances is crucial for patients to navigate the process effectively.

Pre-existing Conditions and TB Skin Tests

Pre-existing conditions can impact coverage for TB skin tests. Some policies may require a waiting period or have restrictions on coverage for tests related to conditions that were present before the insurance policy began. This may involve a deductible or coinsurance. For example, if someone has a history of respiratory issues, the insurance company might consider the TB skin test related to a pre-existing condition, leading to limited or delayed coverage.

The subtle currents of fate, like the intricate design of a TB skin test, often elude our grasp. Just as the question of insurance coverage for such a test may lead to further inquiries, pondering whether your car insurance covers fire damage can offer a similar journey of understanding. Delving into the intricacies of does car insurance cover fire prompts a deeper reflection on the unseen forces at play, ultimately guiding us back to the fundamental truth of insurance coverage for TB skin tests: it depends.

A profound understanding emerges from the journey.

This is a critical consideration for individuals with pre-existing health conditions.

Employment-Related TB Skin Tests

Many employers require TB skin tests for certain job roles, particularly those involving close contact with vulnerable populations. Insurance coverage for these employment-related tests might be different from routine medical tests. For example, if a healthcare worker needs a TB skin test for a job requirement, the insurance company may cover the cost, as it’s directly related to job duties and public health.

However, if the test is for a personal health concern unrelated to employment, the coverage might be different.

Detailed Claim Process Example

The claim process for a TB skin test can vary, but generally involves these steps:

- Obtain a pre-authorization (if required): Contact the insurance provider to determine if pre-authorization is needed and to obtain the necessary information.

- Gather necessary documentation: This typically includes the patient’s insurance information, a copy of the doctor’s order for the test, and any pre-authorization forms.

- Schedule the TB skin test: Arrange the appointment with the healthcare provider.

- Receive the test results: The healthcare provider will provide the results, which typically include a report of the reaction to the skin test.

- Submit the claim: Send the claim form, along with the required documentation to the insurance company.

- Receive reimbursement: The insurance company will review the claim and provide reimbursement according to the policy’s terms. This process often takes several weeks.

Policy Excluding or Limiting TB Skin Test Coverage

Some insurance policies explicitly exclude or limit coverage for TB skin tests, especially for routine or preventative care. This is often part of the policy’s exclusions or limitations. A specific example would be a policy that covers TB skin tests only if they are medically necessary and directly related to a diagnosed or suspected TB infection. This means the patient must demonstrate a clear link between the test and an existing or potential health concern, rather than for general preventative health screening.

Policies with such restrictions may also specify a limit on the amount reimbursed or the maximum number of tests covered within a specific period.

“Coverage for TB skin tests may vary significantly based on the specific policy and its terms and conditions. It is crucial to review the policy document carefully for complete details.”

Preventive Care and Public Health Initiatives

TB skin tests play a crucial role in preventative healthcare by identifying individuals at risk of developing active tuberculosis (TB). Early detection allows for prompt treatment, preventing the spread of the disease and mitigating severe health consequences. This proactive approach is vital for maintaining public health and reducing the burden of TB.

TB Skin Tests in Preventative Healthcare, Does insurance cover tb skin test

TB skin tests, often part of routine preventative health screenings, help identify latent TB infection. A positive result indicates prior exposure to the bacteria and the need for further evaluation and potential treatment. This proactive approach is critical in preventing the progression of latent TB to active TB, which can lead to serious health complications and transmission to others.

Public Health Programs and Access to TB Skin Tests

Public health programs are instrumental in providing access to TB skin tests, particularly in vulnerable populations. These programs often offer free or low-cost screenings, ensuring equitable access to preventative care. Collaborations between local health departments, community organizations, and healthcare providers are key to reaching underserved populations.

Government and Employer-Sponsored Programs’ Influence

Government and employer-sponsored programs can significantly influence insurance coverage for TB skin tests. Legislation and policies that mandate or incentivize preventive screenings, such as TB tests, can impact the cost and availability of these services. For example, some employers may require TB testing for certain employees working in high-risk environments, like healthcare settings.

Public Health Organizations Offering Resources

Various public health organizations provide valuable resources on TB skin tests and related information. These resources often include guidelines, educational materials, and contact information for local health departments.

- Centers for Disease Control and Prevention (CDC): The CDC is a primary source for information on TB prevention, diagnosis, and treatment. Their website offers detailed guidelines, fact sheets, and resources for healthcare professionals and the public.

- World Health Organization (WHO): The WHO provides global leadership in public health matters and has extensive information on TB, including prevention strategies and global TB control programs.

- Tuberculosis Association (local and national): Local and national tuberculosis associations offer valuable resources, support, and advocacy for individuals and communities affected by TB. These organizations often have regional expertise and can provide localized information and support.

Ultimate Conclusion

Jadi, intinya, coverage TB skin test itu tergantung banget sama polis asuransi masing-masing. Penting banget buat ngertiin detail polis lo dan dokumen apa aja yang dibutuhkan buat klaim. Jangan lupa cek dengan pihak asuransi langsung untuk memastikan. Semoga artikel ini membantu lo! Sekarang, lo udah lebih siap buat ngecek kesehatan dan ngurusin klaim asuransi, kan?

FAQ Insights: Does Insurance Cover Tb Skin Test

Apakah saya perlu rujukan dokter untuk tes TB skin?

Biasanya iya, perlu rujukan dokter. Cek detail polis asuransi lo untuk memastikan.

Berapa lama waktu tunggu hasil tes TB skin?

Biasanya beberapa hari atau seminggu. Tergantung fasilitas medis dan protokol.

Apakah asuransi saya menutupi biaya tes TB skin jika saya sudah punya riwayat penyakit?

Bisa jadi iya atau tidak, tergantung kondisi dan detail polis. Cek dengan pihak asuransi untuk kepastian.

Bagaimana jika hasil tes TB skin saya positif?

Biasanya dokter akan memberikan langkah-langkah selanjutnya, termasuk perawatan yang mungkin diperlukan. Pastikan untuk mengikuti arahan dokter dan konsultasikan dengan pihak asuransi.