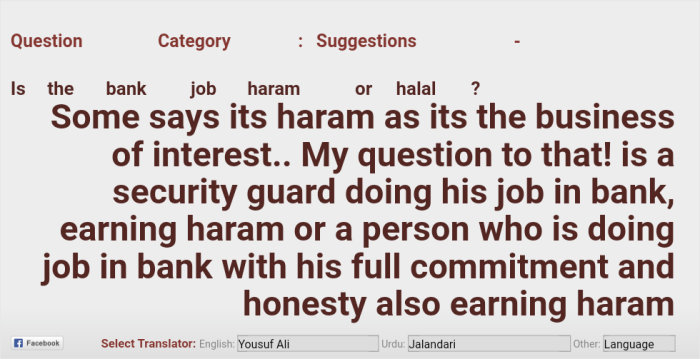

Is working for a bank haram? This crucial question delves into the complex intersection of Islamic finance and conventional banking practices. Navigating the ethical considerations for Muslims working in traditional financial institutions requires careful examination of Islamic principles, particularly those surrounding interest (riba), uncertainty (gharar), and profit-sharing (mudarabah). This exploration will unravel the intricacies of permissible and non-permissible roles within a conventional bank, offering a comprehensive understanding of the issue.

The debate surrounding this topic often involves diverse interpretations of Islamic law. Different schools of thought and individual perspectives may lead to varied conclusions. Understanding the underlying principles and exploring alternative financial options within Islamic frameworks are essential aspects to consider when examining the permissibility of working for a conventional bank.

Islamic Perspectives on Financial Institutions: Is Working For A Bank Haram

Islam emphasizes ethical conduct in all aspects of life, including finance. Islamic finance, therefore, aims to create a system that aligns with Islamic principles, avoiding practices deemed harmful or unjust. This approach prioritizes fairness, transparency, and social responsibility, distinguishing it from conventional financial systems.

Islamic Principles Related to Interest (Riba) and Financial Transactions

Islamic finance strictly prohibits riba, which encompasses any form of interest or usury. This principle stems from the belief that interest creates an unfair advantage for lenders and exploits borrowers, particularly those with limited financial resources. Islamic transactions, therefore, must be based on mutual benefit and shared risk, rather than exploitative lending practices. This prohibits charging or receiving interest on loans.

Instead, transactions are structured around profit-sharing, ensuring both parties benefit from the venture’s success or share in potential losses.

Profit-Sharing (Mudarabah) and its Application in Modern Finance

Mudarabah is a core concept in Islamic finance, representing a profit-sharing partnership. In this arrangement, one party (the investor) provides capital, while the other (the manager) contributes expertise and effort. The profit is then shared between them according to a pre-agreed ratio. Modern applications of mudarabah include investment funds, venture capital, and even structured financing solutions. For instance, a bank might invest in a business venture alongside a client, sharing in the profits or losses in a predetermined manner.

Prohibition of Gharar (Uncertainty) in Islamic Finance and its Relation to Banking Practices

Gharar, meaning uncertainty or ambiguity, is another crucial principle in Islamic finance. Transactions involving significant uncertainty are prohibited. This principle ensures that all parties are aware of the terms and conditions, minimizing risks and potential exploitation. In banking, this translates to avoiding contracts with unclear terms, high levels of speculation, or hidden risks. For example, a contract for a loan with a variable interest rate that could fluctuate significantly might be considered gharar.

Halal and Haram in the Context of Working for a Bank

The concept of halal (permissible) and haram (forbidden) in Islam is crucial when evaluating a career choice. Working for a conventional bank that engages in riba-based transactions could be considered haram, depending on the individual’s role and the specific tasks involved. Islamic banks, on the other hand, operate according to Islamic principles, making employment in such an institution halal.

A thorough understanding of the bank’s operations is vital to ascertain compliance with Islamic principles.

Comparison of Islamic and Conventional Banking Practices

Islamic banking differs significantly from conventional banking in its approach to finance. Conventional banks typically operate on interest-based lending, whereas Islamic banks focus on profit-sharing models and ethical transactions. This fundamental difference impacts various aspects of banking, from deposits to loans.

Key Differences Between Islamic and Conventional Banking Products

| Feature | Islamic Banking | Conventional Banking |

|---|---|---|

| Loans | Based on profit-sharing or other risk-sharing mechanisms. | Based on interest (riba). |

| Deposits | Usually structured as profit-sharing accounts or accounts with a predetermined return rate. | Typically offering interest-bearing accounts. |

| Investment Products | Focus on ventures with clear profit and loss potential. | May include investments with higher risk profiles and potential for substantial returns. |

Ethical Considerations in Islamic and Conventional Banking

| Feature | Islamic Banking | Conventional Banking |

|---|---|---|

| Fairness | Prioritizes fairness and equity in all transactions. | May be perceived as less fair in some transactions due to interest-based models. |

| Transparency | Emphasizes transparency and clarity in contracts and transactions. | Transparency may vary depending on the institution and transaction. |

| Social Responsibility | Aims to promote social welfare and economic development. | May not explicitly prioritize social welfare in the same way. |

Working for a Bank in the Islamic Context

The pursuit of livelihood is a fundamental right in Islam, and working for a financial institution is permissible. However, Muslims must ensure their work aligns with Islamic principles, particularly regarding the prohibition of riba (interest). This necessitates careful consideration of ethical considerations, potential conflicts of interest, and the nature of various roles within a conventional banking system.Navigating the complexities of conventional banking while upholding Islamic values requires a nuanced understanding.

Muslims employed in such institutions must be mindful of the inherent differences between conventional and Islamic finance and actively seek to minimize any potential compromise of their faith. This section delves into the ethical dilemmas, permissible and non-permissible roles, and practical responsibilities faced by Muslims in this context.

Ethical Considerations for Muslims in Conventional Banks

Ethical considerations for Muslims working in conventional banks revolve around upholding Islamic values while performing their duties. This involves understanding the permissible and non-permissible aspects of conventional banking practices in light of Islamic teachings. The core principle is to avoid actions that lead to riba, gharar (uncertainty), or may exploit vulnerable individuals.

Potential Conflicts of Interest

Potential conflicts of interest arise when a Muslim employee’s professional obligations clash with their Islamic values. This might manifest in situations where a transaction or policy directly promotes riba or gharar, or when an employee’s personal gain is prioritized over adherence to Islamic principles. A conscientious Muslim employee must proactively identify and mitigate such conflicts.

Permissible and Non-Permissible Roles

Roles in a conventional bank can be categorized based on their potential compatibility with Islamic principles. Permissible roles typically involve tasks that do not directly involve interest-based transactions or promote practices deemed haram (forbidden). Non-permissible roles, conversely, are those that are inherently intertwined with riba or other forbidden practices.

Detailed Description of Roles

Various roles within a conventional bank have varying degrees of involvement in transactions that could be considered problematic from an Islamic perspective. For example, a teller handling cash transactions may have limited involvement, whereas a loan officer approving interest-bearing loans is significantly involved in a potentially haram transaction. A thorough analysis of each role’s responsibilities is crucial to determine its alignment with Islamic principles.

Responsibilities of a Muslim Employee

A Muslim employee in a conventional bank has a crucial responsibility to ensure their actions align with Islamic values. This includes prioritizing ethical considerations, actively seeking out opportunities to adhere to Islamic principles, and reporting any potentially problematic situations to their superiors or relevant authorities. Maintaining personal integrity and avoiding direct involvement in prohibited transactions is paramount.

Categorization of Bank Roles (Islamic Perspective)

| Category | Role Description |

|---|---|

| Permissible | Customer service representatives, tellers (limited interaction), back-office support staff, certain administrative roles. |

| Questionable | Loan officers, investment bankers involved in interest-based transactions, certain financial analysts whose work is intrinsically linked to interest calculations. |

| Prohibited | Roles directly involved in the creation, structuring, or management of interest-based financial products. |

Examples of Haram Transactions

| Transaction Type | Description |

|---|---|

| Interest-bearing loans | Loans that charge interest, a practice considered haram in Islam. |

| Speculative investment schemes | Investments that rely heavily on risk or gharar, potentially leading to haram outcomes. |

| Insurance policies with uncertain benefits | Insurance products with clauses that might violate Islamic principles, especially those with ambiguous payout scenarios. |

Specific Banking Activities and Islamic Law

Assalamu alaykum. Today, we delve into the intricate relationship between Islamic principles and the practicalities of conventional banking. We will analyze various financial products, exploring their compatibility with Islamic law and examining the permissibility of investments in conventional institutions. This crucial examination will guide us in understanding the nuances of navigating the financial landscape while adhering to our faith.Conventional banking systems often employ practices that are deemed contrary to Islamic principles.

This necessitates a careful evaluation of specific financial products and investments, ensuring they align with Sharia guidelines. Understanding these differences allows us to make informed choices that uphold our faith while participating in the modern economy.

Permissibility of Different Financial Products

Understanding the permissibility of different financial products requires a nuanced approach. The key lies in recognizing transactions that involve interest (riba), gambling (maysir), or uncertainty (gharar). Conventional banks often rely on interest-based models for loans and investments, a practice deemed haram in Islam. Profit-sharing, on the other hand, is considered permissible (halal) as it aligns with the concept of partnership and shared risk.

This distinction forms the basis for Islamic finance products.

Examples of Financial Products and their Islamic Status

- Loans (Qard): Loans with interest (riba) are haram. Islamic banks offer Qard, interest-free loans, aligning with Sharia principles. This is based on the concept of lending as a charitable act without expectation of profit.

- Investments (Mudarabah/Musharakah): Investments based on profit-sharing (Mudarabah or Musharakah) are permissible. In Mudarabah, one party provides capital, and the other provides expertise, sharing the profits according to a pre-agreed ratio. Musharakah involves joint ownership and shared risk and reward.

- Investment Accounts: Conventional investment accounts often involve interest, making them generally haram. Islamic investment accounts, however, typically operate on profit-sharing principles.

- Derivatives: Many derivative products involve speculation and uncertainty (gharar), making them generally haram. Exceptions may exist in specific circumstances, but careful consideration is crucial. The potential for excessive risk and uncertainty is a significant factor in determining their permissibility.

Permissibility of Investments in Conventional Banks

Investment in conventional banks is generally considered haram. This is due to the inherent interest-based nature of many of their products. While some may argue for exceptions, the principle of avoiding riba (interest) remains paramount. However, specific circumstances may be considered in a case-by-case analysis. The lack of profit-sharing and the presence of interest inherently contradict Islamic principles.

Role of Risk Assessment and Profit-Sharing

Risk assessment is crucial in both conventional and Islamic finance. In Islamic finance, profit-sharing models inherently incorporate risk assessment. By sharing profits and losses, both parties are incentivized to manage risk effectively. This contrasts with conventional finance, where risk is often borne primarily by the lender. Profit-sharing in Islamic finance promotes a more equitable and sustainable approach to risk management.

Comparison of Investing in Conventional and Islamic Stocks

Investing in conventional stocks often involves indirect exposure to interest-based activities. Islamic stocks (Sukuk), on the other hand, are structured to comply with Sharia principles. Investing in Islamically compliant stocks provides a pathway to participate in the market while adhering to Islamic principles. This adherence ensures that investments align with ethical considerations.

Table of Financial Products and their Status

| Financial Product | Islamic Status | Explanation |

|---|---|---|

| Conventional Loans | Haram | Interest-based loans are forbidden in Islam. |

| Mudarabah | Halal | Profit-sharing investment where one party provides capital, and the other provides expertise. |

| Musharakah | Halal | Joint ownership and shared risk and reward investment. |

| Conventional Investment Accounts | Generally Haram | Often involve interest and do not align with profit-sharing principles. |

| Conventional Stocks | Generally Haram | Often involve indirect exposure to interest-based activities. |

| Islamic Stocks (Sukuk) | Halal | Structured to comply with Sharia principles, avoiding interest and uncertainty. |

Individual Interpretation and Contextual Factors

The permissibility of working in a conventional banking sector under Islamic law is a multifaceted issue. While some scholars unequivocally condemn it, others offer nuanced perspectives, highlighting the crucial role of individual interpretation and contextual factors in shaping these viewpoints. This necessitates careful consideration of varying schools of thought and the importance of seeking guidance from knowledgeable scholars.A deeper understanding of these nuances is vital for Muslims seeking clarity on this matter, acknowledging that diverse viewpoints exist and that the interpretation of Islamic law is not monolithic.

Different contextual factors, including the specific nature of banking activities and the individual’s personal circumstances, significantly influence the assessment of whether such employment is permissible.

Varied Interpretations of Islamic Law

Diverse interpretations of Islamic law regarding conventional banking practices stem from differing approaches to applying Islamic principles. Different schools of thought and their methodologies contribute to this variation. Some schools emphasize strict adherence to specific prohibitions within the Quran and Sunnah, while others utilize a more flexible approach, considering contemporary circumstances and evolving societal norms.

Schools of Thought and Their Approaches

The Hanafi, Maliki, Shafi’i, and Hanbali schools of thought offer varying perspectives on the permissibility of working in a conventional bank. Hanafi scholars, for instance, often allow for employment in conventional banks under certain conditions, emphasizing the importance of avoiding prohibited transactions like interest (riba). Conversely, some Shafi’i scholars may view such employment as generally forbidden due to the inherent presence of interest in these institutions.

Importance of Consulting Religious Scholars

Seeking guidance from knowledgeable and qualified religious scholars is crucial in navigating the complexities surrounding working in a conventional banking sector. These scholars can provide insightful interpretations of Islamic law and offer tailored advice based on individual circumstances and potential risks. The ability to engage in informed discussion and obtain personalized guidance is paramount.

Concept of Ijtihad in Islamic Jurisprudence

Ijtihad, the independent reasoning of legal scholars in deriving rulings based on Islamic principles, plays a critical role in addressing contemporary issues like conventional banking. Ijtihad allows for the adaptation of Islamic law to new situations while maintaining its core values. However, ijtihad must be conducted with deep understanding of the Quran and Sunnah and in consultation with other knowledgeable scholars.

Determining if working for a bank is religiously prohibited hinges on interpretations of Islamic finance principles. While some argue that certain banking practices involving interest (riba) are haram, the financial intricacies involved in operating a food truck, such as rental costs ( how much do food trucks cost to rent ), often involve ethical considerations and the application of Islamic principles.

Ultimately, the permissibility of working in the banking sector depends on the specific bank’s practices and adherence to Sharia law.

Influence of Cultural and Societal Factors

Cultural and societal factors can influence interpretations of Islamic finance. Local customs, economic realities, and societal expectations can impact the approach taken by individuals and communities towards working in conventional banking. This highlights the dynamic interaction between religious principles and worldly circumstances.

Factors Affecting the Determination, Is working for a bank haram

The determination of whether working for a bank is permissible under Islamic law depends on various factors, including the specific nature of the banking activities, the level of involvement in prohibited transactions, the individual’s understanding of Islamic principles, and the degree to which they are striving to avoid such transactions. These factors contribute to the complexity of this issue.

Table of Interpretations from Various Islamic Scholars

| Scholar/School of Thought | Interpretation on Working in a Conventional Bank | Specific Considerations |

|---|---|---|

| Imam Hanafi | Generally permissible under certain conditions, emphasizing avoidance of interest (riba). | Requires careful scrutiny of specific banking activities to ensure compliance with Islamic principles. |

| Imam Shafi’i (Some scholars) | Generally forbidden due to the inherent presence of interest in conventional banking. | May allow for exceptions in certain circumstances based on specific considerations. |

| Contemporary Islamic Scholars (Example) | Permissible if the individual can minimize involvement in transactions considered forbidden, such as those related to interest. | Emphasizes the importance of individual efforts to fulfill Islamic principles in the context of their work. |

Alternative Financial Options

Seeking financial solutions aligned with Islamic principles offers a viable alternative to conventional banking practices. This approach emphasizes ethical considerations and avoids practices deemed contrary to Islamic teachings. This exploration delves into the structure and operations of Islamic banking institutions, highlighting their services and processes.Islamic banking, rooted in Islamic jurisprudence (Sharia), provides a framework for financial transactions that adheres to ethical guidelines.

This framework distinguishes it from conventional banking, which often includes practices that Islamic teachings consider objectionable. By understanding the nuances of Islamic banking, individuals can explore financial options that align with their values and beliefs.

While Islamic jurisprudence offers differing opinions on the permissibility of working in a bank, some argue that certain banking practices, particularly those involving interest (riba), are forbidden. This complex issue often involves nuanced interpretations of Islamic principles. However, the beauty and intricate craftsmanship of fashion royalty dolls for sale, like those featured on this website, fashion royalty dolls for sale , highlights the artistry and meticulous detail found in various human endeavors.

Ultimately, determining if working for a bank is haram depends on the specific activities involved and the individual’s interpretation of Islamic law.

Availability of Islamic Banking Institutions

Islamic banking institutions are globally recognized and operate in numerous countries. Their presence reflects the growing demand for ethical and principle-based financial services. These institutions provide alternatives to traditional banks for those seeking financial products and services aligned with Islamic principles.

Structure and Services Offered by Islamic Banks

Islamic banks operate on principles that prohibit interest (riba) and speculation (gharar). This necessitates alternative financial instruments, such as profit-sharing (mudarabah), leasing (ijara), and investment (musharakah). These instruments form the bedrock of Islamic banking, providing a framework for various financial transactions while adhering to Islamic law. These services are tailored to meet the needs of diverse clients, from personal finance to corporate banking.

Process of Seeking Financial Services within Islamic Frameworks

The process of securing financial services through Islamic banks mirrors conventional processes, though with key differences. The selection of appropriate products is based on their alignment with Islamic principles. Clients work with bank representatives to determine the most suitable financial instruments for their needs, ensuring compliance with Sharia.

Advantages and Disadvantages of Working in an Islamic Bank Versus a Conventional Bank

Advantages of working in an Islamic bank often include the avoidance of interest-based transactions, aligning with ethical principles. This creates a sense of ethical fulfillment for employees. However, the limited range of available products compared to conventional banks can sometimes be a disadvantage. Additionally, the stringent adherence to Islamic principles in every transaction can pose a challenge for some.Conversely, conventional banks offer a wider array of products and services, along with a more established and often simpler process.

However, the ethical implications and potential conflict with Islamic principles can be a significant disadvantage for those seeking ethical financial services.

Resources Available to Learn More About Islamic Banking and Finance

Numerous resources are available to delve deeper into Islamic banking and finance. Academic journals, online forums, and educational institutions provide comprehensive insights into the theoretical and practical aspects of Islamic finance. These resources offer valuable insights for those interested in exploring Islamic banking as a career path or for personal financial planning.

Islamic Banks and Their Services (Table)

| Islamic Bank | Country(s) of Operation | Key Services |

|---|---|---|

| Islamic Development Bank (IDB) | Various countries in the Middle East and Africa | Development finance, investment, and advisory services for member countries |

| Maybank Islamic | Malaysia, Singapore, and other ASEAN countries | Personal and corporate banking, Islamic investment products, and financing services |

| Dubai Islamic Bank | UAE | Personal banking, corporate banking, investment, and financing services |

| Qatar Islamic Bank | Qatar | Retail banking, corporate banking, investment, and financing services |

Ending Remarks

In conclusion, determining whether working for a bank is haram hinges on a careful consideration of Islamic principles, individual interpretations, and contextual factors. The discussion underscores the importance of consulting with knowledgeable religious scholars and understanding the nuances of Islamic finance. By understanding the available alternative financial options within the Islamic framework, individuals can make informed decisions aligning with their religious values.

Detailed FAQs

Is working in a bank’s investment department considered haram?

Whether investment roles are haram depends on the specific transactions involved. Some investment activities within a conventional bank may violate Islamic principles due to interest-based transactions or uncertainty (gharar). Consulting with religious scholars is crucial for determining the permissibility of specific roles.

What are the potential conflicts of interest for a Muslim working in a conventional bank?

Conflicts arise when a Muslim employee is required to participate in transactions deemed haram, such as those involving interest or speculation. The pressure to adhere to conventional banking practices might also clash with Islamic ethical principles.

Are there any permissible roles within a conventional bank for a Muslim employee?

Certain roles, such as those focusing on customer service, risk assessment (with ethical considerations), or accounting (that does not involve interest-based transactions), might be permissible. The key is to ensure that the role doesn’t involve direct participation in interest-based transactions or practices deemed haram.

How does the concept of ijtihad (independent reasoning) apply to this topic?

Ijtihad allows for diverse interpretations of Islamic law. Individuals might use their reasoning to determine whether specific banking roles or transactions are permissible, but consulting with religious scholars is essential to gain clarity and ensure alignment with established principles.